Learning Forex Technical Analysis: Essential Instruments and Techniques for Effective Trade

Forex trading is a dynamic and quick situation where achievement be contingent on knowing market variations. Technical analysis, a key tool in the trader’s collection, assists traders in making well-versed choices based on historic performance and market trends. To investigates important devices and techniques that enable traders to improve their trading success by mastering 外匯技術分析.

Technical Analysis:

Fundamentally, technical analysis involves identifying patterns and trends from price chart analysis that could potentially indicate future market behaviour. Technical analysis depends just on historical price movements and volume data, unlike basic analysis, which emphasizes economic indicators and news events. Through price action analysis, traders may project possible market reversals, continuations, and breakouts, therefore enabling more confident trade execution.

Basic Instruments for Technical Examination

1. Price Charts

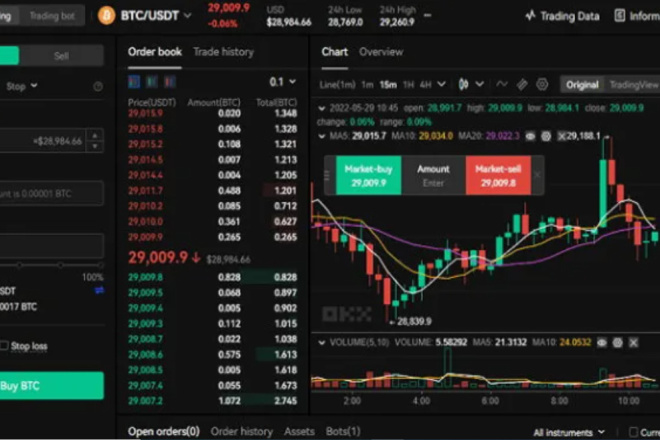

Technical analysis’s basis is price charts, which graphically show market fluctuations across several time spans. Line charts, bar charts, and candlestick charts rank highest among the often-used charts. Because they allow additional information—such as opening, closing, high, and low prices within a certain period—candlestick charts are especially common among them. Knowing candlestick patterns helps one to grasp possible price reversals and market attitude.

2. Technical Indicators

Technical indicators help traders see trends and possible places of exit or entrance by means of mathematical computations grounded on price and volume data. Some often used indications are:

- Moving averages help to smooth price data so that trends may be found. Popular selections among traders are the simple moving average (SMA) and exponential moving average (EMA).

- Index of Relative Strength by tracking price movement speed and change, this momentum oscillator helps traders spot overbought or oversold situations.

- Comprising a central band (SMA) and two outside bands reflecting standard deviations from the SMA, Bollinger Bands offer information on possible price breakouts or reversals.

3. Support and Resistance Levels

Important ideas in technical study are support and resistance levels. While resistance is a level whereby selling pressure might prevent the price from climbing, support is a price level whereby purchasing interest is strong enough to keep the price from declining further. Setting stop-loss orders to control risk and determining these levels will enable traders to decide on entrance and exit locations as well.

Those traders trying to improve their performance in the cutthroat foreign exchange industry must first learn forex technical analysis. Using important instruments including price charts, technical indicators, and support and resistance levels helps traders create informed plans that raise their chances of success. Long-term profitability in 外匯技術分析 depends on constant learning and market circumstance adaptation, just as in any trading discipline.